Introduction

In 2025, managing your personal finances is no longer a tedious chore thanks to the rise of AI-powered finance tools. These innovative technologies are reshaping how we budget, save, and spend by automating complex tasks and providing real-time, personalized financial insights. Whether you’re looking to control expenses, optimize savings, or plan for the future, AI-driven budgeting apps and platforms are making money management smarter and easier than ever before.

In this blog, we will explore how AI-powered finance tools are revolutionizing personal budgeting, the key features that set them apart, the benefits to consumers, and what the future holds for financial technology.

What Are AI-Powered Finance Tools?

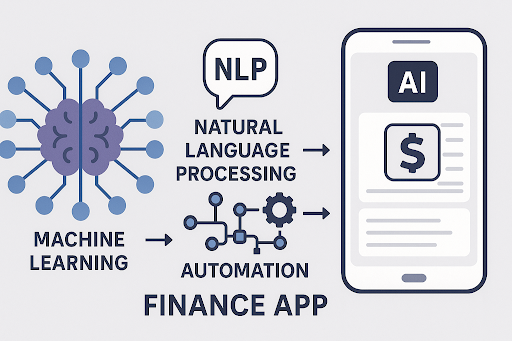

AI-powered finance tools leverage artificial intelligence, machine learning, and big data analytics to automate and enhance financial management. These tools are designed to analyze vast amounts of financial data, recognize patterns, and provide actionable recommendations tailored to individual users’ habits and goals.

Unlike traditional budgeting methods that require manual tracking and calculations, AI-Powered Finance tools automate tasks such as categorizing expenses, forecasting future spending, and identifying saving opportunities—all in real-time.

Key Components Include:

- Machine Learning Algorithms: Adapt to your spending behavior over time and personalize budgeting advice.

- Natural Language Processing (NLP): Enables conversational interfaces or chatbots to answer your finance questions.

- Predictive Analytics: Forecast future expenses or income to help you plan ahead.

- Automation: Automatically sync transactions from bank accounts, credit cards, and bills.

Why Personal Budgeting Needs AI in 2025

The world of personal finance has grown increasingly complex. From managing multiple bank accounts and credit cards to keeping up with subscriptions and fluctuating incomes, the traditional pen-and-paper or spreadsheet methods are no longer practical for most.

Here’s why AI is essential for budgeting today:

- Real-Time Data: Financial situations change daily. AI tools update budgets instantly based on new transactions and market changes.

- Complex Expense Patterns: AI understands spending habits across categories, providing more precise insights than manual methods.

- Personalized Advice: Generic budgeting tips don’t work for everyone. AI personalizes recommendations based on your unique financial profile.

- Stress Reduction: Automating mundane tasks saves time and reduces anxiety around money management.

Top Features of AI-Powered Budgeting Tools in 2025

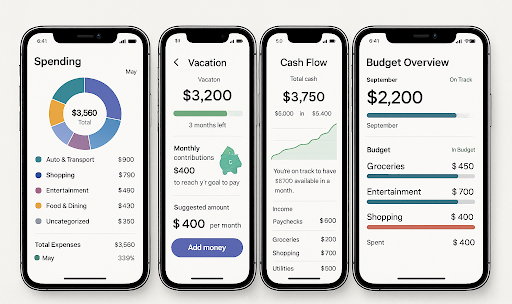

1. Automated Expense Tracking and Categorization

AI-Powered Finance tools automatically categorize your transactions (e.g., groceries, utilities, entertainment) by analyzing transaction data. This saves hours each month and ensures your budget is always accurate.

2. Real-Time Budget Updates

Every purchase or bill payment syncs instantly, letting you see exactly where your money is going—no manual entries required.

3. Personalized Financial Insights

AI analyzes your spending trends and highlights areas where you can cut costs or optimize savings. For example, it may suggest lowering recurring subscription fees you no longer use.

4. Predictive Budgeting

Using past data, AI predicts upcoming expenses such as seasonal bills, medical costs, or large purchases, helping you prepare ahead.

5. Goal Setting and Tracking

Set savings goals like a vacation or emergency fund, and AI monitors your progress, offering tailored tips to stay on track.

6. Alerts and Notifications

Get notified if you are nearing budget limits or if unusual transactions occur, increasing your financial security.

7. Integration with Financial Ecosystems

AI-Powered Finance tools now seamlessly connect with banks, credit cards, investments, loans, and even crypto wallets, providing a comprehensive financial overview.

Benefits of Using AI-Powered Finance Tools for Budgeting

Increased Accuracy and Efficiency

Manual budgeting is prone to human error. AI automates calculations and data entry, ensuring accuracy and saving valuable time.

Personalized and Actionable Advice

AI learns your habits and adapts, offering practical steps to improve your financial health—far beyond static budgets.

Better Money Management and Savings

By identifying unnecessary expenses and predicting future cash flow, AI tools help you avoid overspending and build savings.

Enhanced Financial Literacy

Many AI apps provide educational insights and financial tips customized to your needs, empowering better decisions.

Stress-Free Money Management

Automated tracking and real-time alerts reduce anxiety and help you stay in control of your finances effortlessly.

Case Studies: How AI Budgeting Changed Users’ Lives

Sarah’s Story: Cutting Costs with AI Insights

Sarah struggled with keeping her monthly expenses under control. After switching to an AI budgeting app, she discovered she was paying for multiple streaming services she rarely used. The app suggested downgrading, saving her $30 a month, which she redirected toward her student loans.

Mike’s Story: Achieving His Dream Vacation

Mike used AI tools to set a savings goal for a summer trip. The app tracked his spending patterns and automatically suggested small daily savings. Within six months, Mike reached his target without feeling deprived.

The Future of AI-Powered Finance Tools in Personal Budgeting

As AI technology advances, we can expect even more revolutionary features, including:

- Voice-Activated Budgeting: Use natural speech to add expenses or check budgets.

- Deeper Behavioral Analysis: Predict spending triggers and suggest personalized habit changes.

- Financial Wellness Coaching: AI-powered virtual advisors offering holistic advice, from investments to debt management.

- Enhanced Security: AI-driven fraud detection and real-time risk assessments.

- Cross-Platform Synchronization: Seamless budgeting across devices, banks, and financial products worldwide.

How to Choose the Right AI-Powered Finance Tools for Budgeting in 2025

When selecting an AI finance tool, consider these factors:

- Security: Look for apps with strong encryption and multi-factor authentication.

- Integration: Ensure it supports your bank accounts, credit cards, and financial services.

- User Experience: Choose apps with intuitive interfaces and responsive customer support.

- Customization: The ability to set personalized budgets, goals, and alerts.

- Cost: Many tools offer free versions, but premium plans often provide advanced AI features.

- Reviews and Reputation: Check user feedback and expert reviews to assess reliability.

Getting Started: Steps to Begin Using AI-Powered Finance Tools

- Assess Your Current Financial Situation: Gather recent bank statements and bills.

- Research Available Tools: Compare features of popular AI budgeting apps like Mint, YNAB with AI enhancements, PocketGuard, or Cleo.

- Download and Link Your Accounts: Most apps require secure bank integration for real-time data syncing.

- Set Budget Categories and Financial Goals: Customize according to your lifestyle.

- Review AI Recommendations Regularly: Use insights to adjust spending and save more efficiently.

- Maintain Financial Discipline: Use notifications and progress reports to stay accountable.

Conclusion

In 2025, AI-powered finance tools are not just a luxury they’re becoming a necessity for smart personal budgeting. By automating mundane tasks, providing personalized insights, and forecasting future spending, these tools empower individuals to take control of their finances like never before.

Whether you want to optimize daily spending, save for a big goal, or simply reduce money stress, AI budgeting apps offer a revolutionary approach to managing your money with ease and intelligence. Embrace AI in your personal finance journey and experience the future of budgeting today.

Discover the latest in International News, Fashion Trends, Travel Ideas, and Financial Updates — all in one place.

👉 Don’t miss out — Click below to explore now!